Wells Fargo’s AI CoE was developing its AI architechture with model-agnostic large language models (LLMs) and partnering with Microsoft to enhance banker workflows within MS Teams– Wells Fargo's primary ecosystem for collaborative work. A myriad of use cases indicated a common need to break siloes, optimize search results and speed, and detect critical anomalies. Our design initiative would generate conversational and collaborative capabilities (natural language prompts, AI agents and collaborative criticism) and extend LLMs to existing banker tools, bolstering productivity, collaboration and security.

Sean Hanrahan

AI at Wells Fargo

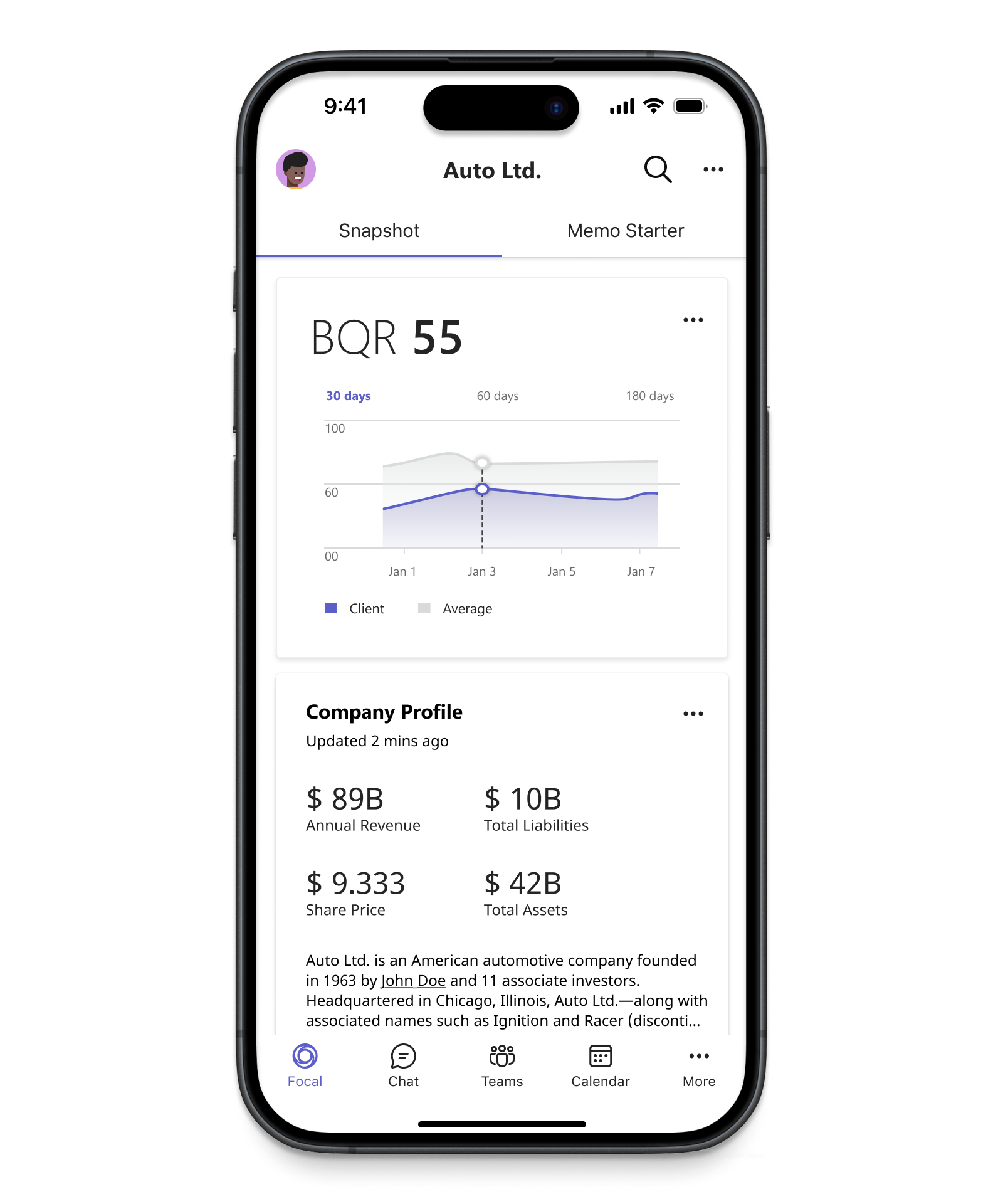

Every day, bank employees navigate countless procedures, evolving regulations, and complex banking systems—all while ensuring fast, accurate assessment and decision-making. To supercharge bankers and streamline performance, Wells Fargo built a suite of AI tools including large language models for 35,000 bankers across 4,000 branches.

Problem

Contributions

From discovery to validation, I led design of a top company priority to assess new opportunities for AI deployment and generate solutions for internal employees to improve productivity and streamline collaboration.

Discovery

Partnered with internal stakeholders, executives and SMEs. Conducted interviews and co-led a 3-day design workshop to discover opportunities and generate early concepts

Strategy & Design

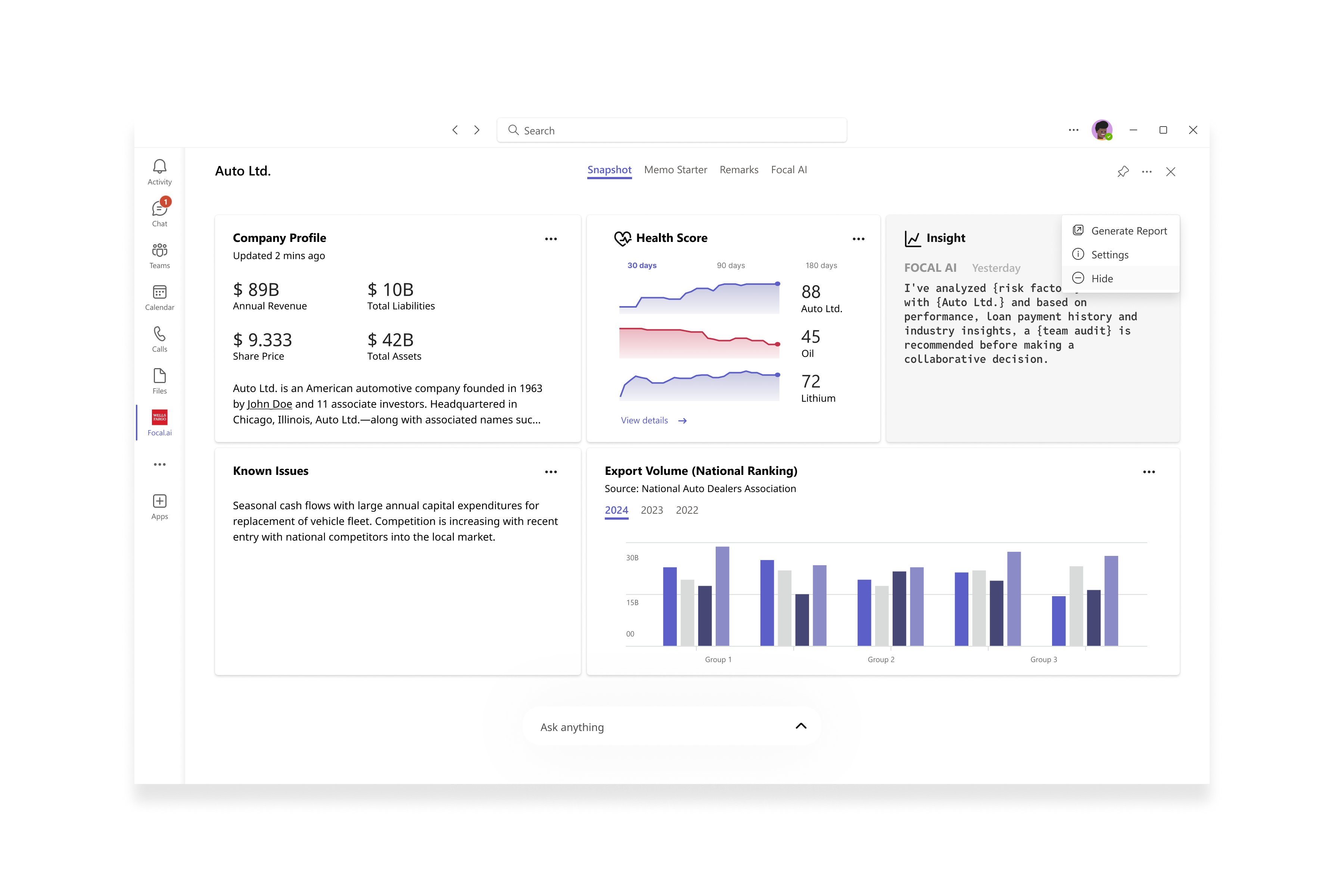

Depicted net new concepts and built custom components in Figma to support existing workflows and extend to Microsoft Teams apps (primary platform for collaborative tasks and file sharing)

Prototyping

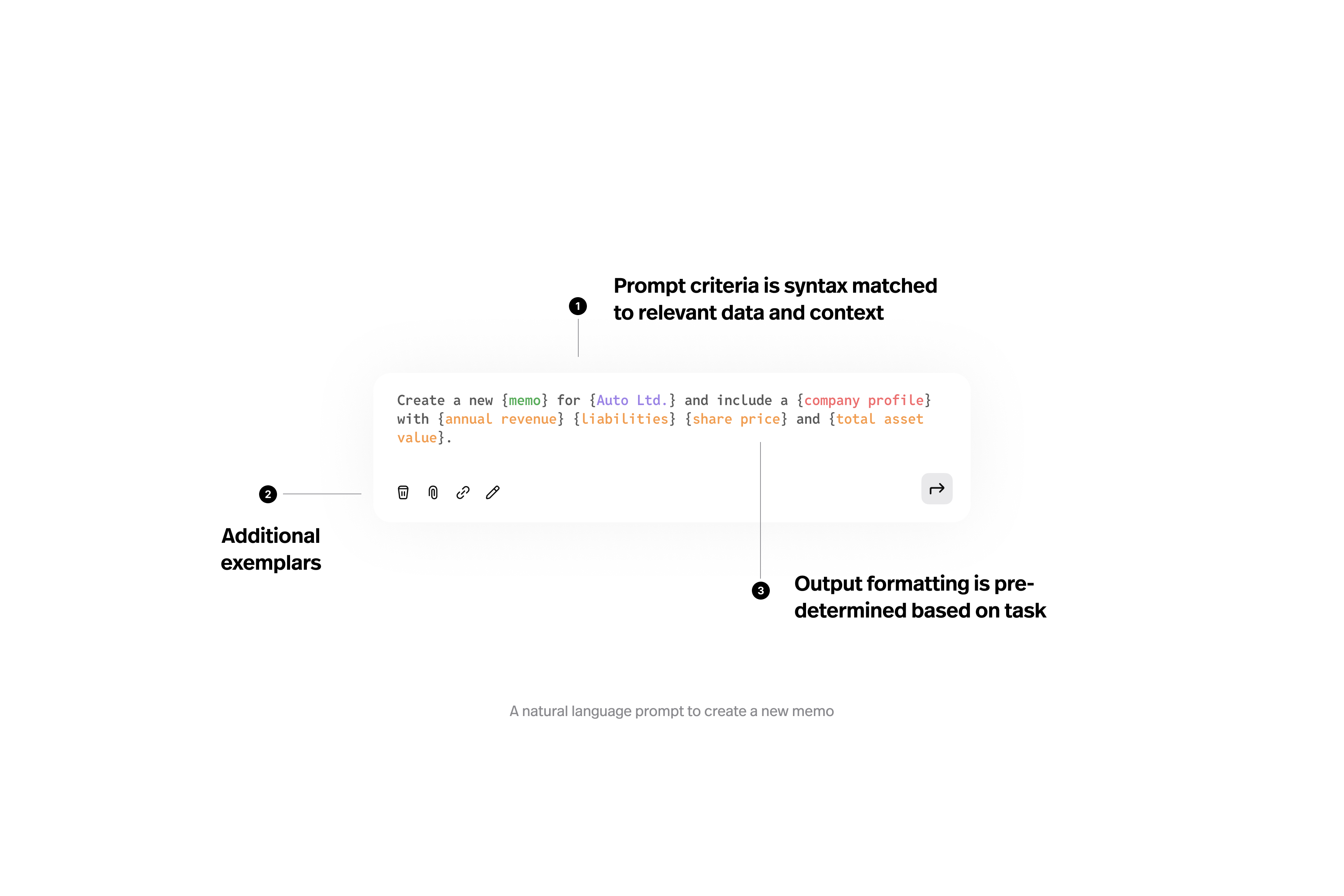

Extensive prototyping and rapid iteration with product and engineering teams. Built Microsoft Teams apps, components, and functionality including demos with APIs and LLMs

Testing & Handoff

Validated concepts and features with 3 rounds of user testing, then shipped net new component library to engineers with implementation guidance

Key Insights

In-depth interviews with relationship managers and portfolio managers revealed a deep understanding of opportunity areas and pain points

1. Siloed Workflows

Teams are part of a fluid ecosystem with the same goal yet tools are siloed

2. Analysis to Anomaly

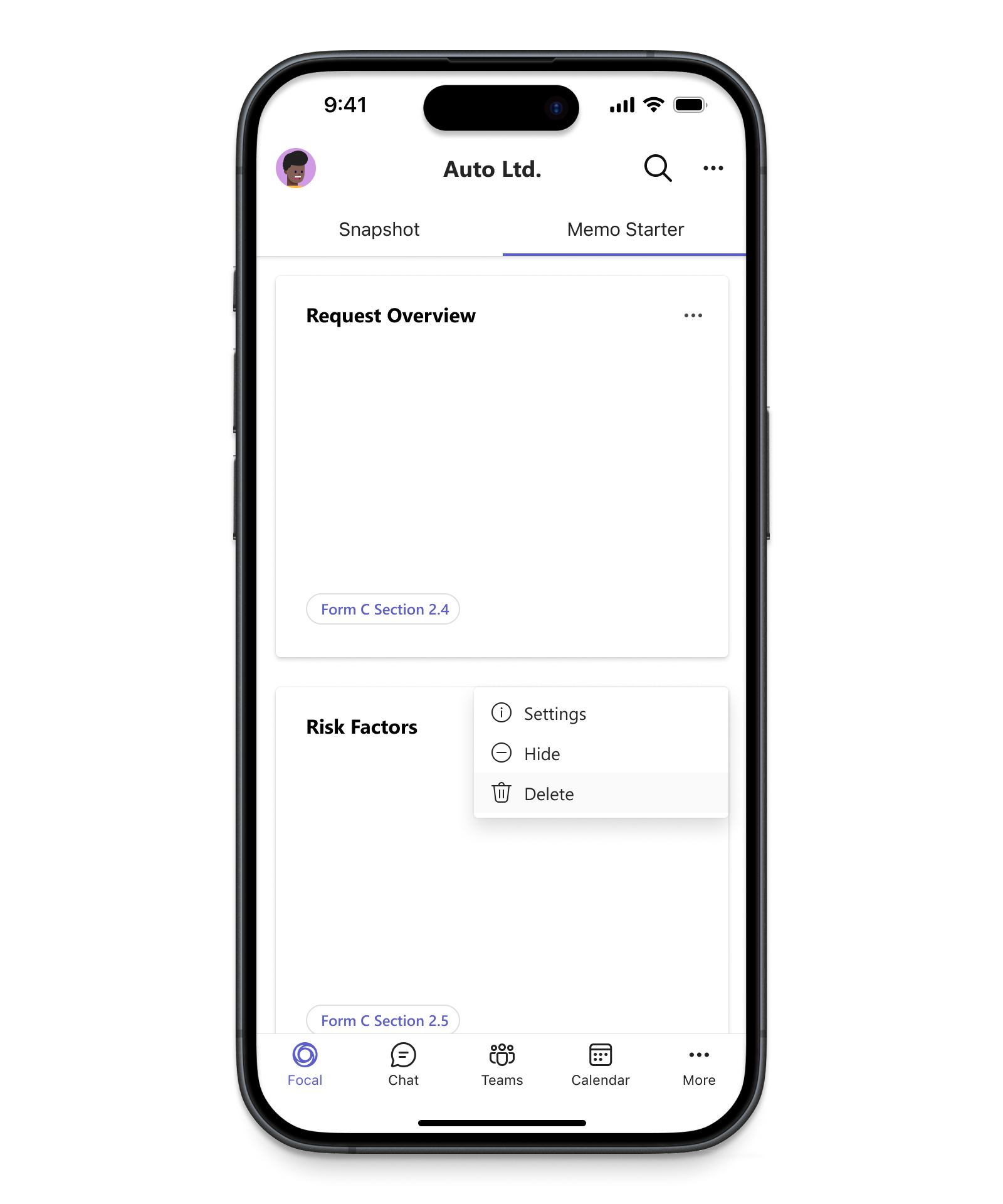

Teams find critical anomalies and changes, then must create explanations to process deal

3. Tools Take Time

Managers feel lost and overwhelmed when searching for policy and critical resources

4. Consistency is Key

Managers are handicapped by lack of consistency and history; leads to errors

Solution

Prototyping with MS Teams toolkit formed the foundation to build conversational and collaborative capabilities (natural language prompts, AI agents and collaborative criticism). Search and generate features extended LLMs to existing banker tools, bolstering productivity, collaboration and security. Prompt engineering with syntax matching allows bankers to use natural language to search documents and policy, and generate new documents and collaborative workflows.

Impact

This initiative led to new internal tools deployed in 2025 to 35,000 bankers. I am a joint inventor to patents now pending. Wells Fargo plans to soon extend its capabilities with agentic AI and LLMs to additional teams to better secure customer data and respond to emerging use cases.

35k

bankers can access large language models to locate information they need

30s

cut response time from 10 minutes to just 30 seconds

75%

of all searches take place through the AI agent

3

rounds of user testing to validate new concepts and component library

Images and components included in this project overview were created by me. I utilized generative AI tools to depict some visuals. This file contains property of Wells Fargo. Do not copy, upload or share without express permission.